If you use VMD, you must abide by the license agreement. If this does not work, try typing module load vmd before running vmd.

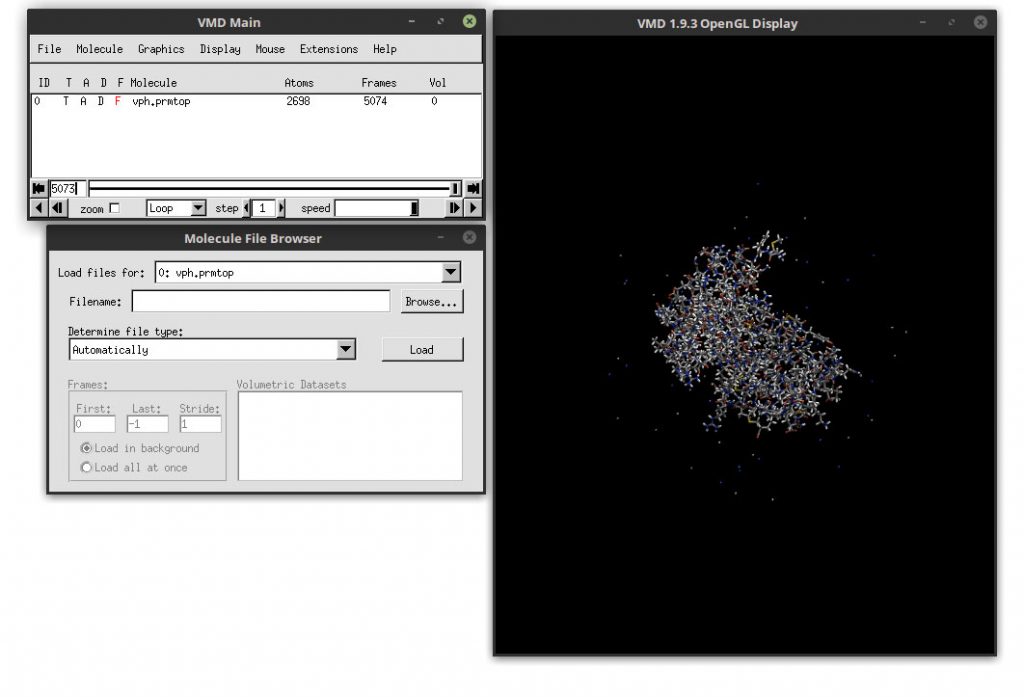

UsageĪs a convenience, you can just type vmd to start the latest version of VMD from /usr/tce/bin. Stereo is disabled by default because it conflicts with certain implementations of X11. To enable stereo, start VMD by typing vmd_stereo. The module load vmd command will setup your PATH and any other needed environment variables. The actual installation directories are in /usr/tce/packages/vmd. You can specify a particular version in the module command, e.g., module load vmd/1.9.3. Type module avail vmd to see the available options. Multiple versions may be accessible via modules. Links to the latest version exist in /usr/tce/bin. VMD is developed by the Theoretical and Computational Biophysics Group (TCBG) of the University of Illinois at Urbana-Champaign. In particular, VMD can act as a graphical front end for an external MD program by displaying and animating a molecule undergoing simulation on a remote computer. VMD can be used to animate and analyze the trajectory of a molecular dynamics (MD) simulation. VMD provides a wide variety of methods for rendering and coloring a molecule: simple points and lines, CPK spheres and cylinders, licorice bonds, backbone tubes and ribbons, cartoon drawings, and others. It may be used to view more general molecules, as VMD can read standard Protein Data Bank (PDB) files and display the contained structure. Simply Wall St has no position in any stocks mentioned.VMD (Visual Molecular Dynamics) is designed for the visualization and analysis of biological systems such as proteins, nucleic acids, lipid bilayer assemblies, etc. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. We aim to bring you long-term focused analysis driven by fundamental data. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. This article by Simply Wall St is general in nature.

Alternatively, email editorial-team (at). Have feedback on this article? Concerned about the content? Get in touch with us directly.

#VMD MOVIES FULL#

This may not be consistent with full year annual report figures. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated.

#VMD MOVIES FREE#

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts. Case in point: We've spotted 2 warning signs for Viemed Healthcare you should be aware of.

But to understand Viemed Healthcare better, we need to consider many other factors. It's always worth thinking about the different groups who own shares in a company. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run. The general public- including retail investors - own 32% stake in the company, and hence can't easily be ignored. It might be worth checking if those insiders have been buying recently. It is great to see insiders so invested in the business. Insiders own CA$30m worth of shares in the CA$259m company. It seems insiders own a significant proportion of Viemed Healthcare, Inc. This can be negative in some circumstances. However, high insider ownership can also give immense power to a small group within the company. Insider ownership is positive when it signals leadership are thinking like the true owners of the company. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it. Our data reflects individual insiders, capturing board members at the very least. The definition of company insiders can be subjective and does vary between jurisdictions. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future. The same can be achieved by studying analyst sentiments. Researching institutional ownership is a good way to gauge and filter a stock's expected performance. Looking at the shareholder registry, we can see that 51% of the ownership is controlled by the top 13 shareholders, meaning that no single shareholder has a majority interest in the ownership.

0 kommentar(er)

0 kommentar(er)